💳 Smarter Fraud Detection: A Fuzzy Logic Framework for Real-Time Credit Card Security

- Gnosis Analytics Crew

- Jul 3, 2025

- 2 min read

Credit card fraud is a constantly evolving threat—fast, elusive, and increasingly complex. In our 2024 research, we introduced a robust, real-time fraud detection framework powered by fuzzy logic, offering a new lens for financial security systems to detect suspicious behavior with greater flexibility and interpretability.

🚨 The Challenge: High-Stakes Uncertainty in Real Time

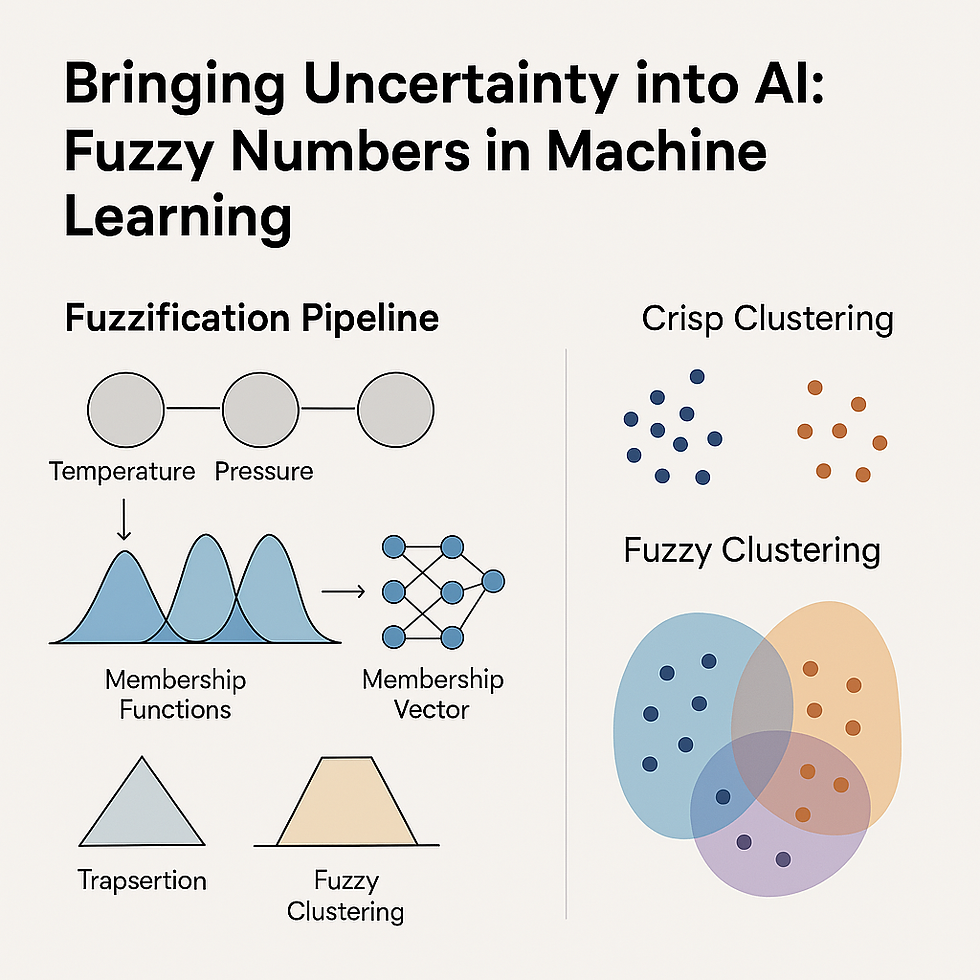

Traditional fraud detection relies on rigid thresholds and historical rule sets. But financial behaviors aren’t black-and-white—there’s a spectrum of transaction patterns that could be normal, borderline, or fraudulent. Relying solely on strict logic creates a trade-off between false positives (annoying users) and false negatives (missing actual fraud).

Plus, in a real-time context, you need a model that responds fast and learns without relying on large retraining cycles.

🤖 The Solution: Fuzzy Logic for Soft Boundaries

Our approach applies fuzzy classification to model uncertainty directly in transaction data. Instead of flagging every deviation as fraud, fuzzy systems evaluate the degree of anomaly across features like:

Transaction amount vs user’s typical range

Time-of-day patterns

Geographic distance between consecutive uses

Spending categories frequency

Using Triangular fuzzy numbers, each input is mapped to a spectrum of risk, enabling the system to flag transactions with nuanced confidence levels. We utilise a real-time version of our fuzzy logistic regression framework, adjusted to also account for temporal patterns in credit card data.

The model can be deployed as an online system, updating in near-real time, and doesn’t require massive retraining to stay effective—ideal for evolving fraud behavior.

🧠 Why It Works

Adaptive to grey zones: Rather than making hard calls, it adjusts thresholds dynamically

Fast and interpretable: Supports real-time classification with transparent logic

Flexible integration: Can be layered on top of existing fraud detection systems

📉 Real-World Value

This fuzzy framework is especially suited for financial institutions, e-commerce platforms, and digital wallets where high transaction volume meets constant change. It reduces manual review workloads while preserving user trust.

📘 Published Work

This research was published in Expert Systems with Applications and demonstrates how soft computing techniques can offer hard security advantages—bridging statistical innovation with practical systems.

Charizanos, G., Demirhan, H., & İçen, D. (2024). An online fuzzy fraud detection framework for credit card transactions. Expert Systems with Applications, 252, 124127.

Comments